25.06.2020

In the first of two surveys, we asked manufacturers what impact covid-19 had on their supply chains, how they were monitoring their supply chains and where their supplier bases were in the world. We explore what this all means in this next blog in the Manufacturing Smart Supply Chains series in partnership with Oracle.

Visibility of entire supply chains is not the norm

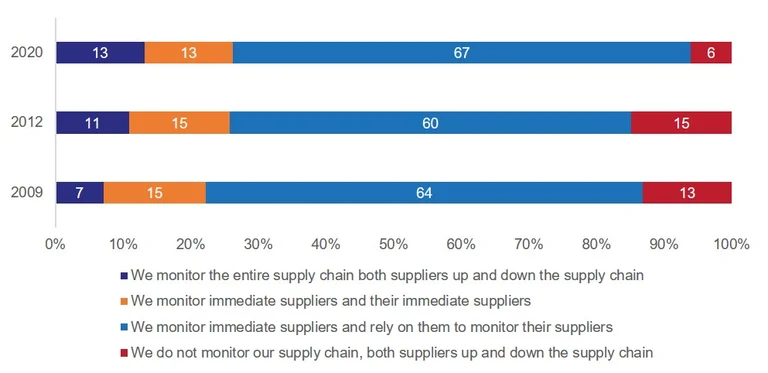

In blog three we spoke about how understanding your supply chains was the first step to building more resilient supply chains. This means knowing where you sit in this journey, and how products and components move between each manufacturer. It is crucial for manufacturers to fully recognise and understand the processes occur within their own supply chain both before and after they add value and provide their own expertise. Yet when we surveyed manufacturers on whether they monitor their supply chain, the majority reported that they only monitor immediate supplier. In most cases this meant OEMs monitoring Tier 1 suppliers:

Source: Make UK / Oracle survey of manufacturers, May 18th to 1st June

Despite the numerous geopolitical events since 2009, little has changed since we asked the same questions in 2009 and in 2012. However on a positive note, the data shows manufacturers are moving in the right direction as we saw the number of manufacturers monitoring their supply chain double from 7% to 13% between 2009 and 2020 whilst the number not proactively monitoring their supply chain has more than halved since 2009, moving from 13% to 6% . There clearly has been progress however that still remains a small proportion of manufacturers who have the visibility they need to begin to mitigate the impact of shocks to their supply chains. It is evidently clear, the visibility gap for manufacturers remains.

Company suppliers haven't changed much in the past two years

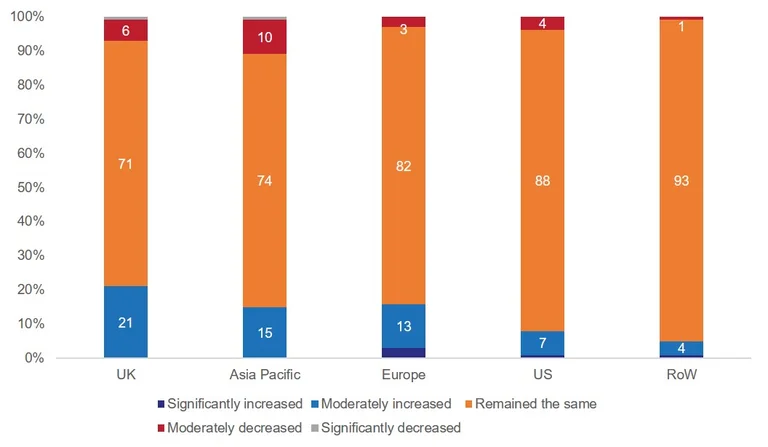

As we think about building supply chains that shift in focus from ‘just in time’ to ‘just in case’ we may see changes in where manufacturers’ supplier bases are. This includes, diversification across different continents to help mitigate the impact of geopolitical events in one particular region. Itis also too early to tell if attitudes shift and if supply chain networks shorten following the latest Covid-19 pandemic. As previously explained, supply chain networks are truly global for a reason and take time to alter and change.

Source: Make UK / Oracle survey of manufacturers, May 18th to 1st June

Covid-19 halted supply chains, with revenue, orders and cash flow taking a hit

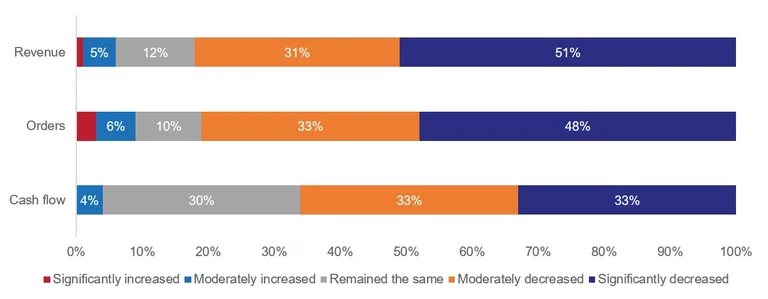

Unsurprisingly our survey found that the greatest impact of Covid-19 on manufacturers was felt on revenues - over half (51%) reported a significant decrease, and a further 31% reporting a moderate decrease. It was a similar picture for orders too, with 48% seeing a significant decrease, and 33% seeing a moderate decrease. These results are unsurprising given demand fell dramatically as lockdowns were imposed and supply chains came to halt.

Source: Make UK / Oracle survey of manufacturers, May 18th to 1st June

What can we learn from this geopolitical event?

Whilst the sector's supply chains have undoubtedly been hit hard by the current pandemic, there have also been positive takeaways. It is abundantly clear the vital role UK manufacturing plays in being a critical sector to our economy. Much of this success hinges on supply chains that connect us to new markets, and new opportunities through highly integrated global networks.

But visibility of supply chains remains key, and currently there are not enough manufacturers looking up and down the supply chain to identify where they can be reinforced. Advancements in technology have increased the visibility across networks and also made it far easier and cost effective for manufacturers to gather and scrutinise data both internally and across their own supply chain networks. Now is the time to ask more and more questions up and down supply chains.

- How can we work with you to reduce lead-times? Is the information we share with you accurate and timely? Could it be more helpful? Is there any more information you need from us?

- How could we improve our reliability?

- Do you have the ability for further personalisation?

- Do you have capacity to increase quantities by 25%? What would this do to cost?

Blog authors Bhavina Bharkhada (Make UK Senior Campaigns & Policy Manager) and David Fagan (External Affairs Executive). Get involved in the conversation @MakeUKCampaigns @SCMOracle @OracleERPCloud #MakeitSmart